This year, July 4th brought more than just fireworks—it was a big day for the future of corporate community investments. Previously, companies were limited in the maximum amount (10% of taxable income) they could claim as a tax deduction. But now after the One Big Beautiful Bill Act (OBBBA) cleared Congress, companies also face a minimum amount (1% of taxable income) they must donate before being eligible for a corporate tax deduction on their community investments. This May at our annual Summit, one week after the 1% floor proposal was initially released, CECP conducted a poll of the senior Corporate Social Responsibility (CSR) leaders in attendance, 37% of respondents said their corporate community investment decisions were not driven by tax-deductibility. However, 46% said it was a moderately significant factor, 13% said it was a very significant factor, and 3% said it was a critical factor.

CECP strongly believes that corporate community investment is most impactful when it is voluntary, strategic, and aligned with a company’s core values and stakeholder interests. We have consistently advocated that companies should aim for a Total Community Investment (TCI)—which includes corporate cash, foundation cash, and non-cash contributions—of at least 1% of pre-tax profit, with 2% as the benchmark for top-performing companies. We trust that businesses are best equipped to decide how to allocate their resources, and CECP remains committed to supporting you and your teams in your efforts to create positive social impact while achieving business success.

Recent research from Allstate underscores the power of local engagement, revealing that 68% of Americans are active in their communities and that those with higher trust levels are nearly twice as likely to be engaged—78% compared to 44%. With trust in institutions declining globally, this data shows that community investment can play a critical role in rebuilding trust, strengthening civic fabric, and driving long-term prosperity.

Whatever your company’s primary motivator is for its community investments, CECP has identified four options companies can explore with their CSR, finance, and tax teams to continue community investments in light of this new floor.

Option 1: Stay the course: maintain your current community investment strategy

- If the tax deductibility of your company’s community investments is not a big incentive or essential to your social impact strategy, stay the course and maintain your current levels of corporate community investments.

- Consider increasing your community investment budgets during years when revenue may be higher.

Option 2: Lean into your corporate foundation

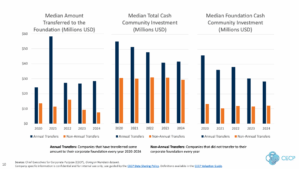

- If your company has a corporate foundation, consider transferring larger, tax- advantageous amounts on a beneficial basis. A beneficial basis (non-annual) is one that is determined by the company and could mean a year in which the revenues were significantly higher than other years. CECP data shows that companies who used non-annual transfer cadences –or transferring every two, three, or five years–to their corporate foundations were better able to maintain a consistent level of community investments, versus those that only provided transfers on an annual basis.

Option 3: Consider taking certain social impact programs as qualified business expenses

Ordinary and necessary business expenses are defined as being ordinary if they’re common and accepted in your industry, or it’s a necessary expense that is helpful and appropriate for your trade or business. It does not have to be indispensable to be considered necessary.

Potential examples include:

- Workforce development or career pipeline programs could fall under miscellaneous educational expenses if they maintain or improve skills needed for your current business.

- Volunteer projects in the local operating communities where your employees and customers live and work could fall under intangibles and goodwill as employees perform valuable volunteer services in those areas.

Option 4: Intermittent influx of community investments

- If direct cash is your company’s primary funding type for community investments, consider large cash donations to your nonprofit partners on a beneficial (non-annual) basis that are greater than 1% of taxable income, and therefore tax-deductible, to spend down in subsequent years.

As the landscape of corporate community investment evolves, the introduction of a 1% minimum floor marks a pivotal shift from voluntary generosity to strategic responsibility. Whether your company is driven by purpose, profit, or a blend of both, now is the time to explore your options for maintaining or increasing your community investments. By collaborating across CSR, finance, and tax teams, companies can explore their options and plan around the new floor, unlocking new opportunities for meaningful impact. CECP is here to support your journey—reach out to explore the data, insights, and strategies that will help your organization lead with purpose and precision: info@cecp.co.

**CECP is not a tax advisor and recommends you connect with your internal finance and tax teams when exploring this option. The ability to claim some charitable contributions as ordinary and necessary business expenses may depend on the risk tolerance of your company